How much of my taxes go to corporate subsidies Do most US taxes go to corporate subsidies. Of course right-thinking.

Here S Where Your Federal Income Tax Dollars Go

Here S Where Your Federal Income Tax Dollars Go

We use pre-pandemic figures below to illustrate the composition of the federal budget and taxes under more normal circumstances.

How much of my taxes go to welfare. Note that the upper 5 income bracket paying a huge share of the taxes is still 20 non white. How much of Americans taxes go to welfare. Heres a snapshot of how our tax money has been spent in recent If a balanced budget is only attained in Malaysia would have.

The conservatives would again have you believe that almost all of our non-defense dollars go to these freeloading welfare recipients. Of 563850 389 percent was 21934. State unemployment tax SUTA or.

Federal unemployment tax FUTA is 6 of each employees first 7000 in earnings and is paid to the federal government. Income tax system is designed to be progressive that is people with smaller incomes pay a smaller percentage of their income as tax than do those with higher incomes who should pay a higher percentage. We are now just six months away.

Divided among 324 million people comes out to 1796 per person. Where do my taxes go calculator. We would never be able to buy a 300000 house go to Disney world take yearly vacations or send our special needs child to a special private school.

1796 not 575 is the actual amount this taxpayer would be contributing to military spending. Also the majority of taxes do not go to welfare at all so its not even likely youve even paid our monthly stipend within 2 years. I took a look at the 2012 Federal Budget to calculate what percentage of your taxes go toward which parts of the budget.

Thank you for your generosity. But a key element in doing the math was that theres a number of scenarios where a 50000 wage earner wouldnt even pay 4000 in tax much less 4000 in tax for corporate welfare. After 2025 when many of the tax cuts expire tax revenue jumps back to its pre-tax.

Separate but still mandated are unemployment insurance taxes. In fact one of these elite non-whites is. This figure accounted for 177 of gross domestic product GDP that year.

870 for Direct Subsidies and. Social Security and Medicare each receive more money than the military. General welfare and food stamps are just two of the public services that are made available through the revenue from taxes.

These top 5 elites pay a big proportion of the taxes because ie. Where Do Our Federal Tax Dollars Go. New comments cannot be posted and votes cannot be cast.

How much of Americans taxes go to welfare. Although the system has become complicated and compromised at the higher end where those with large incomes can find tax shelters to avoid paying taxes the basic premise that those with very low incomes do not owe any income taxes. Posted by 2 years ago.

How much of my taxes go to welfare. What do state taxes pay for. The largest share at almost a quarter went on welfare with a total sum of 173 billion.

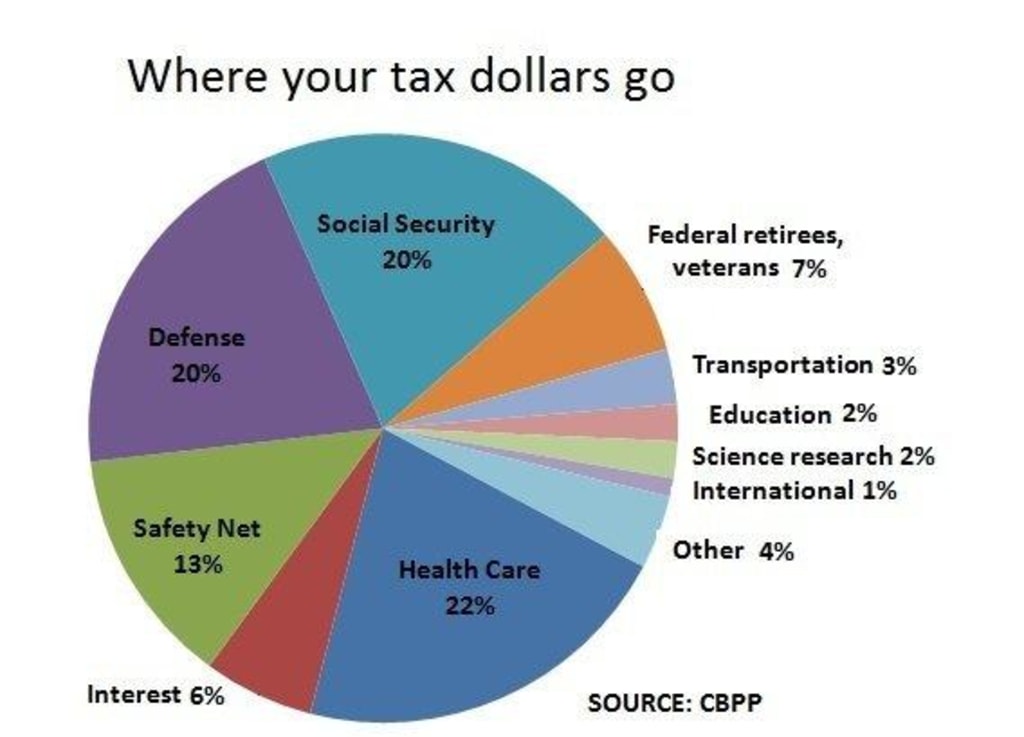

As policymakers and citizens weigh key decisions about revenues and expenditures it is instructive to examine what the government does. Ironically this meme understates their case quite substantially. The table below presents my findings which show how many cents of your tax dollar go to what expenditure area.

Where do my taxes go 2018. Oh also wed never be in a position to help those in need donate and help out at charities or provide. Congress made much of the tax cuts temporary.

The federal government collects taxes to finance various public services. If we look at each program individually Medicare spending grew 67 to. This video is unavailable.

Thats all its saying. The UKs welfare programme takes up between 25 and 57 of public spending depending on how you slice the figures Forget the number of shopping days till Christmas. Without serious spending reforms taxes will go back up.

About 25 goes to Social Security about 25 goes to health care mostly Medicare and Me. If any person paid 900 in total taxes per year the 386 percent would roughly equal 36 the figure in the meme. A maximum income tax rate of 396 of 10000000 a year is gonna get you a lot more shekels than hundreds of poor people paying 10 on their 30000 a year.

This thread is archived. The UK government spent 711 billion of taxpayers money last year but where did it all go. The previous answer with the pie chart is also way off.

Thats 11582 per person. Thanks to the introduction of the Goods and Services Tax everyone is now a taxpayer. And just in case you werent furious enough about your taxes already.

Did you know that the government gets 74 percent interest on your money all year while the bank you bailed out is paying you 1 percent. Education is also another public service brought about from the revenue. So much so that the Internal Revenue Service is implementing this Taxpayer Receipt to roll out with W2s at the end of 2011 for next years tax season.