In the US a tax shelter is loosely defined as any method that recovers more than 1 in tax. TurboTax Has A Variety Of Solutions And Tools To Help You Meet Your Tax Needs.

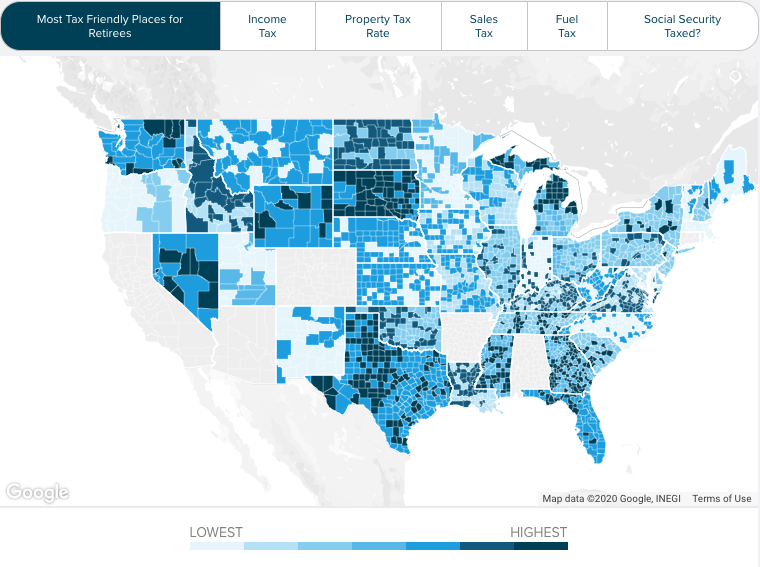

The Best States To Retire For Taxes Smartasset

The Best States To Retire For Taxes Smartasset

Delawares treatment of retirement income is the primary difference between Delaware income and federal adjusted gross income.

Delaware taxes for retirees. When it comes to taxes for retirees Delaware has been named the most tax friendly by Kiplinger. It is also 2000 for retirees less than age 60 and 12500 for those age 60 and up. Mail to State of Delaware Division of Revenue PO BOX 830 Wilmington DE 19899-0830.

Like most states Delaware offers a few different benefits for retirees who choose to spend their golden years there but one benefit can be found in only four other states. The gas tax is less than the national average. Social Security income is not taxable.

The deduction will begin in July of the year following the calendar year for which the earnings are reported. Read on to learn more. Some other forms of military pay may be subject to state taxes.

Social Security and Railroad Retirement benefits are not taxable in Delaware and should not be included in taxable income. In fact the Diamond State is one of only five in the US. NewHomeSource has named the top six cities for retirees in Delaware.

TurboTax Has A Variety Of Solutions And Tools To Help You Meet Your Tax Needs. Social Security benefits are also not taxed which makes Delaware the ideal state for many retirees. Also Delaware has a graduated tax rate ranging from 22 to 555 for income under 60000 and 595 for income of 60000 or over.

Advertentie From Simple To Complex Taxes Filing With TurboTax Is Easy. Delaware called most tax-friendly state for retirees. Military disability retired pay is also exempt as it is covered by federal law which allows for the exemption.

A bonus round considered estate or inheritance another zero. Advertentie From Simple To Complex Taxes Filing With TurboTax Is Easy. Retiring in Delaware will give you access to the historic charm of New England and beautiful beaches on the Atlantic Ocean.

Delaware is tax-friendly toward retirees. With no sales tax and excludes inheritance and personal property from being taxed. Is Delaware Tax-Friendly for Retirees.

Social Security income is not taxed. But the state does have a maximum state income tax of 595 percent. Form 200EX Extension Request Voucher 2020 Request For Extension Formerly 200ES-5E 2020 Instructions.

Delaware Individual Resident Income Tax. If you retire to Delaware state income taxes allow for an exclusion of 12500 from retirement income such as IRAs pensions and 401 k plans. Congratulations Delaware youre the most tax-friendly state for retirees.

Withdrawals from retirement accounts are partially taxed. Since social security benefits are not taxed in Delaware and because up to 12500 of pension income including capital gains interest and dividends is exempt from state taxes for people aged 60 and over many retirees will pay little or no income tax to Delaware. In short the answer is yes Delaware is tax-friendly towards retirees.

A tax shelter is any method of reducing taxable income that results in a reduction of tax payments. Delaware is a beautiful state on the East Coast that gives retirees the chance to enjoy a laidback beachfront lifestyle without having to make the trek to swampy Florida. Theres no sales tax tax-free shopping An additional 2500 standard deduction is available for those over 65.

Kiplingers weighed taxes on income it varies sales zero and property it varies. Estate andor Inheritance Taxes. The state income tax ranges from 22 percent to 555 percent for income under.

Delaware Non-Resident Individual Income Tax Form 200-02 Delaware Non-Resident Individual Income Tax Form Schedule 200-02 Sch Delaware Non-Resident Schedule A Form PIT-NSA Extension Request form. Social Security and Railroad Retirement benefits are not taxable in Delaware and should not be included in taxable income. Income from a pension up to 2000 is also not subject to state income tax in Delaware.

There is no sales tax and property taxes are low so many consider Delaware a bargain for retirement. Like pension income retired military pay qualifies for some exemptions in Delaware. If a retiree does exceed the allowable earnings limit the retirees pension benefit will be reduced over a 12 month period calculated as 1 for every 2 earned over 30000.

Delaware does not levy taxes on Social Security or railroad retirement benefits. Exemptions include Social Security benefits and up to 12500 of investment and pension income for residents 60 and older. The Delaware income tax has six tax brackets with a maximum marginal income tax of 660 as of 2021.

Also Delaware has a graduated tax rate ranging from 22 to 555 for income under 60000 and 660 for income of 60000 or over. Detailed Delaware state income tax rates and brackets are available on this page.