Fidelity rollover IRAs are designed for those who have a retirement plan from a former employer with the potential of more investment options than a workplace plan. Wealthfront invest your money in US and foreign stocks and bonds just like virtually every other robo-advisor.

Save For The Future With A Roth Ira Fidelity

Save For The Future With A Roth Ira Fidelity

Rowe Price have a minimum initial investment of 1000.

Fidelity roth ira minimum. Fidelity full and partial account transfers are free. The 2500 minimum is waived when you enroll in automatic contributions depositing 200 a month in your IRA. Fidelity Investments the major financial services company.

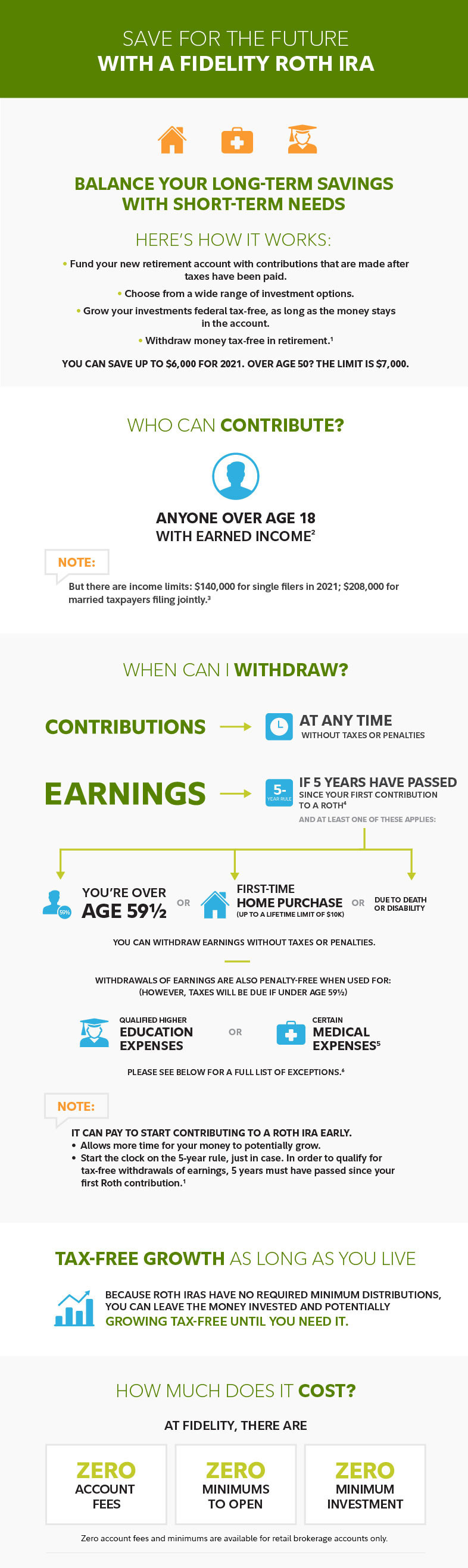

Fidelity Roth IRA has no opening cost closing cost or annual fee. A distribution of earnings from a Roth IRA is federal income tax free if it has met the five-year aging requirement and its owner is at least 59½ deceased or disabled. 4 Periodic investment plans do not assure a profit or protect against a loss in a declining market.

Of the three primary IRA categories Fidelity offers a Roth IRA is the one that has no minimum required distributions. At this point in your life being so young it would probably be best to put it into the SP500 FUSEX or total market FSTVX index fund and just do as well as the market does. For a regular brokerage account the firm requires an initial deposit of at least 2500 to open an account although for an IRA there is no minimum.

Once the IRA has been opened Fidelitys standard commission schedule will apply to the account. You will need a minimum 500 initial deposit to open a Wealthfront Roth IRA. Theres an annual maximum contribution of 6000 per child per year for 2020 and 2021.

The other major advantage is diversification. Treasuries are always free to trade. For a regular brokerage account Fidelity requires a minimum opening deposit of 2500.

To be eligible for the Fidelity Personalized Planning Advice program you must invest and maintain a minimum of 25000 in the aggregate in one or more of your program accounts. First Fidelity Roth IRA accounts have no minimum account balance or any recurring account fees. Paper documents sent through the mail are free a rarity nowadays.

Fidelitys SimpleStart SM IRA process helps you automate saving and investing for retirement with one account application. There are several IRA types available at Fidelity. For example Ally Bank offers certificates of deposit for traditional and Roth IRAs with no minimum investment requirement.

Fidelity Account Minimums IRA Types - 5 5 Opening a Fidelity Roth IRA does not require a minimum deposit amount making it a solid option for investors who are starting out but dont currently have sufficient funds to meet higher initial deposit requirements. Actually starting to invest was foreigner. 4 rows Fidelity minimum amount to open brokerage margin account.

Distributions up to 10000 for a first-time home purchase may also be tax free provided the five-year aging requirement is met. When I came to the realization that I needed to start saving for my future in retirement I found that the best way to start was with a Roth IRA. However some investments like mutual funds do require a minimum initial deposit.

A program account will not be invested according to a selected asset allocation strategy until the account has a. There is no minimum to open the account. These include Roth Traditional Rollover SEP SIMPLE Inherited and Minor accounts.

Fidelity has a minimum initial deposit of 2500 and Vanguard and T. There are plenty of resources online to help you understand the inner workings of Roth IRAs. There is a 50 maximum for short-term bonds and a 250 max for other maturities.

Only 10000 of your account will be subject to the advisory fee which means youll be paying 25 per year to have your 15000 Roth IRA professionally managed for you. Minimum Required Distribution Page 1 of 2 Use this form to request either a one-time or systematic Minimum Required Distributions MRD from your Fidelity Advisor IRA Beneficiary Distribution Account BDA or Fidelity Advisor Roth IRA BDA. A discount broker like Ameritrade has a 500 minimum initial investment.

Helpful to Know Fidelity Investments Institutional Operations Company LLC FIIOC cannot calculate MRDs if. 2500 in cash andor securities. Most Fidelity mutual funds having a 2500 minimum investment so you might need a little bit more money in order to truly diversify.

Margin rates at Fidelity range from 9325 to 50. Wealthfronts annual management fee is. One reason for the higher deposit is that Wealthfront only buys whole shares of index ETFs while Betterment buys fractional shares.

How much does Fidelity charge for Roth IRA. IRA contributions cannot exceed a minors earnings eg if a minor earns 1000 then only 1000 can be contributed to the account. Fidelity IRA Fees and Minimums Retirement accounts at Fidelity come with no account minimums no inactivity fees and no annual fees.

A discount broker is a good choice if you want to purchase individual stocks for your Roth IRA. But for a retirement account there is no minimum required. These are mutual fund companies.

Roth IRA traditional IRA and 401k were all foreign terms to me just a few years ago. The account also offers more than 3400 mutual funds that attract zero transaction fees and commission-free trade on ETFs and stocks.