The accountant said he typed everything into his system correctly. First your refund is low.

Why Is My Tax Return So Low 2020 Tax Year Edition Picnic S Blog

Why Is My Tax Return So Low 2020 Tax Year Edition Picnic S Blog

Only about 5 of people will end up paying more she said.

Why is my tax return so low. Tax on that amount is 495 and with having 590 taking out youd get a 95 refund. Why would we only be getting the 500 tax credit and not the full amount. The answer for your lower refund is your deductions claimed via your W-4.

If you dont have your tax return request tax transcripts from the IRS. You didnt withhold your unemployment income. For some reason Im only getting the dependent -other credit.

Your refund is just the difference between what you withheld throughout the year and what you actually owe. You must have your deductions higher than 2 if you want more tax taken out so that you can get a higher refund next year. The accountant said its because of a 6 month grace.

So if your tax refund is less than expected in 2021 it could be due to a few reasons. Due to withholding changes in 2018 some taxpayers received larger paychecks because they they were paying less in taxes out of their paychecks during the year. When I picked up my taxes I was exited to see what my refund would look like what that new child tax credit.

Reasons for a Small Tax Refund You can have a low tax refund because of many things. One of the main reasons your state income taxes may be higher in 2020 versus 2019 is because you didnt pay in enough state income taxes from your paychecks to cover the taxes based on your income earnings. For those Americans their tax.

The money your coworkers are getting back is what they should have been receiving throughout the. If your refund is wildly off double check the amounts you input a dollar amount mistype can have a big impact on your refund Here are some other possible reasons for a year-over-year refund decrease. On top of the chart there will be your tax withholding which we dive into below.

Your return is what you file to receive your refund. However the 2020 tax season is unparalleled to any other tax year and will likely throw surprises at taxpayers who dont plan ahead. Especially if you didnt file a new Form W-4 after the deductions and credits have changed.

Based on 14000 your taxable income is around 4850. Tax season is here and there are many things you need to be aware of when it comes to your money and taxes especially if you got stimulus money and unemployment funds. With millions of Americans filing for unemployment benefits.

Why is My Tax Refund So Low. If your tax refund is going to be smaller this year unemployment compensation may be a big reason why. Schedule your complimentary 15 min consult here.

In other words your 2020 State Tax Withholding may be lower than 2019. Although you might treat your tax refund like found money a tax refund is like lending. Paychecks largely went up as a result of that overhaul -- but perhaps too much because since that change workers have been collecting lower tax refunds or worse yet owing taxes.

Changes in your income or tax rate State and local income tax deduction changes. Some taxpayers may be in for. If you received a tax refund that was smaller than you expected this year chances are its not a random mistake.

If your income changed or youre no longer entitled to a tax credit or deduction it can lead to a lower tax refund. In most cases lost deductions and credits cause a tax refund to be lower since they have a direct impact. For example if you filled out your Form W-4 when you were employed and your spouse was unemployed but then your spouse got a new job youll be hit with a smaller refund or a larger tax bill at the end of the year in order to account for your increased household income.

Theres no need to panic a lower tax refund can actually be a good thing. There are a number of things that might make your tax refund lower from one year to the next. A small refund actually means your withholdings throughout the year were correct.

The unemployment rate skyrocketed in the US. Refunds being low isnt inherently an issue. The biggest program was the CARES Act which added 600wk in Federal unemployment to existing state benefits.

A variety of programs were launched last year to help Americans who became unemployed due to the Covid-19 pandemic. Take a look at whats possibly caused you to get a lower tax refund this year. Another common reason is losing eligibility to claim certain deductions and credits.

Why is my refund so low. Roughly 80 of taxpayers did indeed end up owing less in taxes as a result of the Tax Cuts and Jobs Act said Nicole Kaeding director of federal projects at the Tax Policy Center a nonpartisan research group. Life changes like getting married or divorced having or adopting children and buying or selling a house have traditionally had an impact on your federal tax return.

Many of taxpayers filing their 2020 returns are wondering the same thing.

Why Is My Tax Return So Low 2020 Tax Year Edition Picnic S Blog

Why Is My Tax Return So Low 2020 Tax Year Edition Picnic S Blog

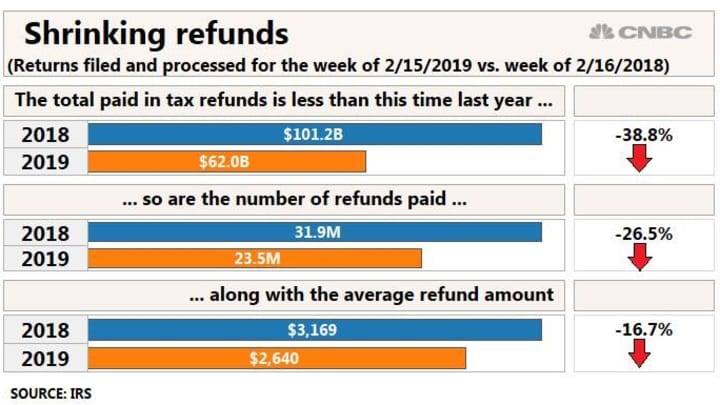

Here S Why The Average Tax Refund Check Is Down 16 From Last Year

Here S Why The Average Tax Refund Check Is Down 16 From Last Year

Taxes 2019 Why Is My Refund Lower For 2019

Taxes 2019 Why Is My Refund Lower For 2019

Why Is My Tax Return So Low In 2021 H R Block

Why Is My Tax Return So Low In 2021 H R Block

Why Is My Tax Return So Low 2020 Tax Year Edition Picnic S Blog

Why Is My Tax Return So Low 2020 Tax Year Edition Picnic S Blog

Who Has To Complete A Self Assessment Tax Return Low Incomes Tax Reform Group

Who Has To Complete A Self Assessment Tax Return Low Incomes Tax Reform Group

Surprised By A Lower Tax Refund It Doesn T Always Mean Your Taxes Went Up Syracuse Com

Surprised By A Lower Tax Refund It Doesn T Always Mean Your Taxes Went Up Syracuse Com

Why Is My Tax Return So Low In 2021 H R Block

Why Is My Tax Return So Low In 2021 H R Block

Will I Owe The Irs Tax On My Stimulus Payment

Will I Owe The Irs Tax On My Stimulus Payment

Why Is My Tax Return So Low 2020 Tax Year Edition Picnic S Blog

Why Is My Tax Return So Low 2020 Tax Year Edition Picnic S Blog

Why Is My Tax Refund So Low Money

Why Is My Tax Refund So Low Money

The Irs Is Behind In Processing Nearly 7 Million Tax Returns An Early Warning Sign The Agency Is Under Strain The Washington Post

The Irs Is Behind In Processing Nearly 7 Million Tax Returns An Early Warning Sign The Agency Is Under Strain The Washington Post

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.