Access selected data on bond yields. View or download the latest data for treasury bill yields treasury bill auctions and treasury bills.

Ted Spread Three Month Libor And Three Month T Bill Interest Rate Download Scientific Diagram

Ted Spread Three Month Libor And Three Month T Bill Interest Rate Download Scientific Diagram

91-day T-bill auction avg disc rate.

T bill interest rate. To access interest rate data in the legacy XML format and the corresponding XSD schema click here. The investor is guaranteed to at least recoup the purchase price but since the US. For example if you were to buy a T-Bill of 10000 for 9900 over a period of 13 weeks then you would have a profit of 100 and a rate of return of 101 US Treasury Bills Calculator Face Value of Treasury Bill.

13 Week Treasury Bill IRX NYBOT - NYBOT Real Time Price. Ten year fixed rate mortgage interest rates change as 10 year T-Bills change 15 year mortgage interest rates change as 15 year bonds change and so on. 3 Month Treasury Bill Rate is at 001 compared to 002 the previous market day and 012 last year.

00080 -00020 -2000 As of 259PM EDT. When the T-Bill matures the investor is paid 1000 thereby earning 50 in interest on the investment. For example say you purchase a T-Bill for 978 and it has a face value of 1000.

Look up the past ten years of data for these series. Interbank Rate in India averaged 721 percent from 1993 until 2021 reaching an all time high of 1297 percent in July of 1995 and a record low of 293 percent in November of 2020. Unlike Treasury notes Treasury bonds and Treasury Inflation-Protected Securities TIPS bills dont pay interest every six months.

Daily Treasury Bill Rates Data. Five-Year Treasury Constant. This is lower than the long term average of 424.

Rarely they have sold at a price equal to the par amount. CSV JSON and XML. Secondary Market Rate DISCONTINUED Percent Not Seasonally Adjusted Daily 1962-02-01 to 2001-08-24 2001-08-24.

Bills are typically sold at a discount from the par amount par amount is also called face value. Daily Treasury Bill Rates. Divide 22 by your purchase price of 978 to find your rate is 00225 or 225 percent.

The annual interest that is calculated is calculated for the information only. Treasury bills or T-bills are sold in terms ranging from a few days to 52 weeks. You would pay 98 for the bill at purchase and you would get 100 when the bill matures.

These rates are the daily secondary market quotation on the most recently auctioned Treasury Bills for each maturity tranche 4-week 8-week 13-week 26-week and 52-week for which Treasury currently issues new Bills. As bond yields increase interest rates for mortgages rise. Subtract 978 from 1000 to find youll earn 22 in interest.

India Treasury Bill 91 Day Yield increased to 333 percent on Friday May 7 from 332 percent in the previous day. Issue Date Tender Security Type Discount Rate Interest Rate. Fixed rate mortgage interest rates are in fact directly affected by the fluctuations in bond yield rates.

Two-Year Treasury Constant Maturity. The difference of 2 is your interest. 182-day T-bill auction avg disc rate.

Trend Following On High Yield Bonds In A Rising Interest Rate Environment

Trend Following On High Yield Bonds In A Rising Interest Rate Environment

Education What Makes Treasury Bill Rates Rise And Fall What Effect Does The Economy Have On T Bill Rates

Education What Makes Treasury Bill Rates Rise And Fall What Effect Does The Economy Have On T Bill Rates

Student Loan Consolidation Comparison

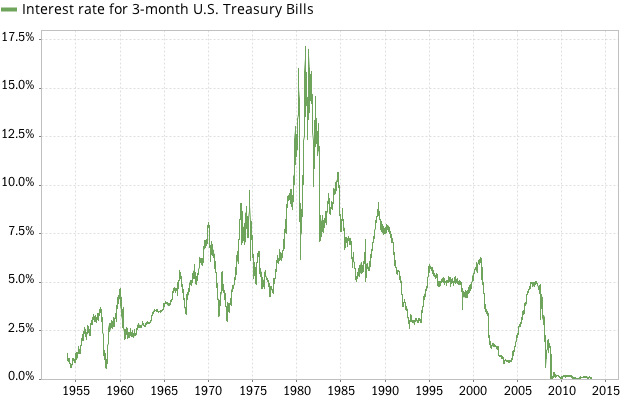

United States Interest Rate United States Interest Rate Us 3 Months Bill Rate Long Term Chart This Is Equivalent With Variable Interest Rate See The Chart Below Us 3 Months Bill Rate Is Also Known As A 3 Month T Bill Rate Or 13 Week Treasury Bill

Who Determines Short Term Interest Rates Angry Bear

Who Determines Short Term Interest Rates Angry Bear

Treasury Bill Vs Real Estate Investment Upside Avenue

91 Day Treasury Bills Csea Africa Centre For The Study Of The Economies Of Africa

Understanding Treasury Yield And Interest Rates

South Western Econdata Interest Rate Spread

Us Treasury Sells Bonds With A 0 Return For The First Time

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.