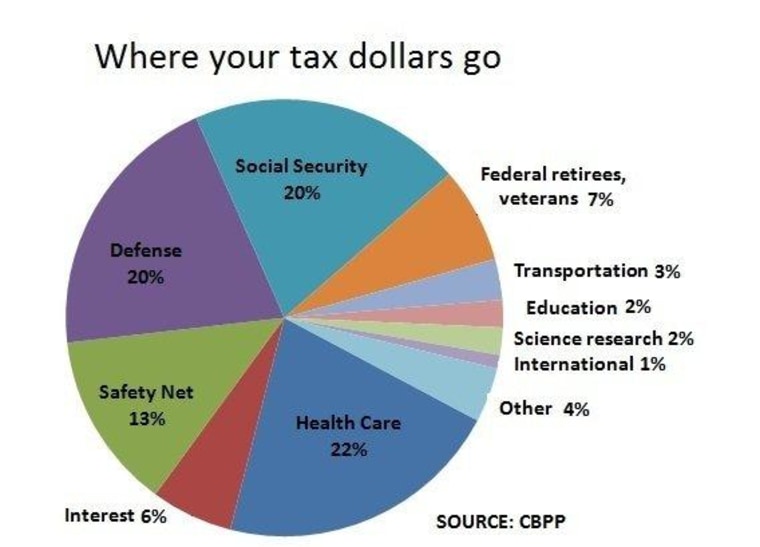

The City of Red Deer collects taxes on behalf of the province for education and Bridges Community Living. For those wondering how federal tax dollars are spent heres a breakdown.

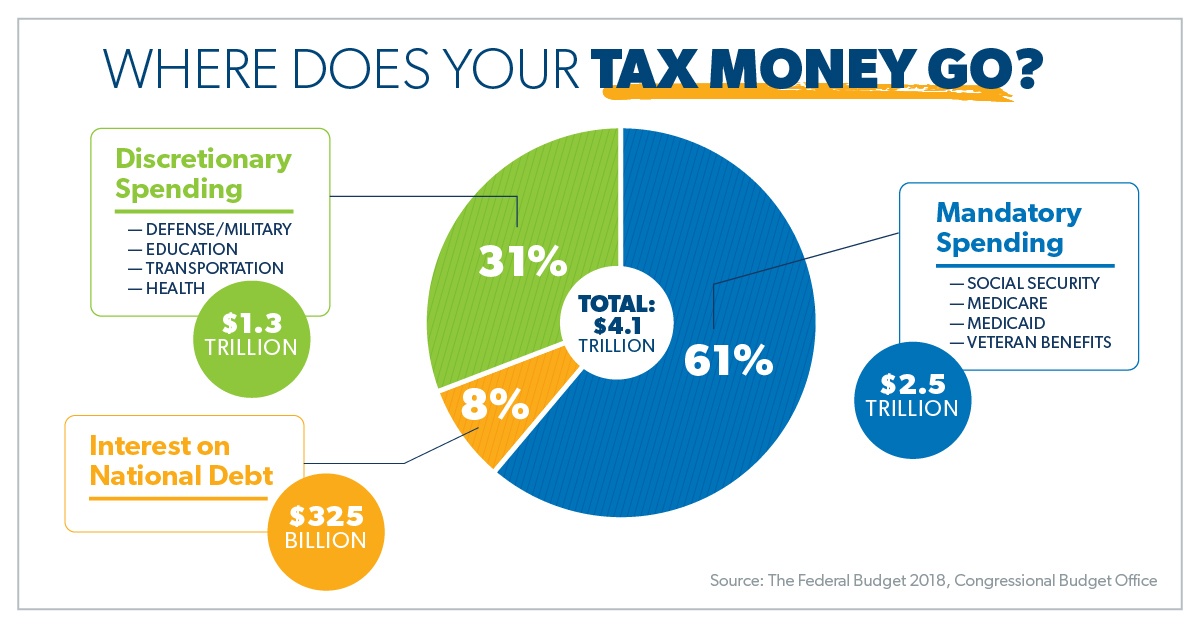

Where Does Your Tax Money Go Ramseysolutions Com

Where Does Your Tax Money Go Ramseysolutions Com

Much of that money goes back to Canada as 74 percent of the debt is held domestically by citizens and institutions through federal bonds treasury bills and similar products.

Tax dollar breakdown. Department of Finance CanadaCBC News You can spend hours reading through hundreds of pages from the last budget. Interest on government debt 8 Mandatory spending also known as entitlement spending which is not subject to regular budget review 61. For a country of 37 million people thats 135 per citizen.

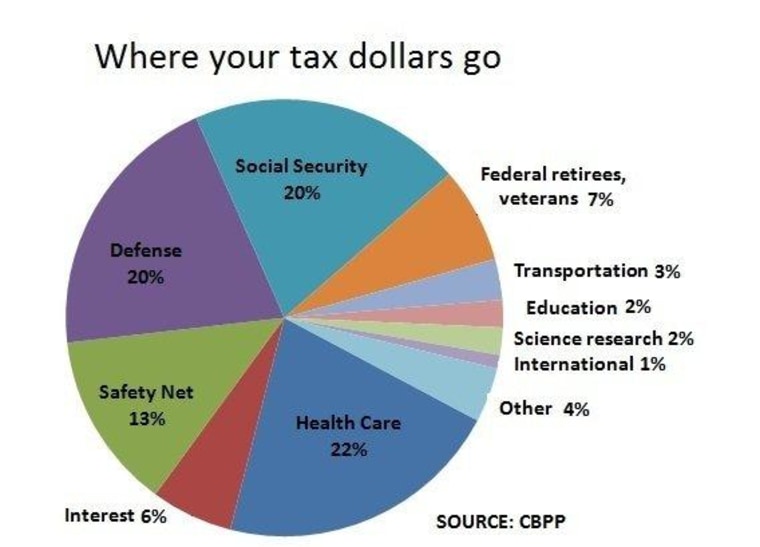

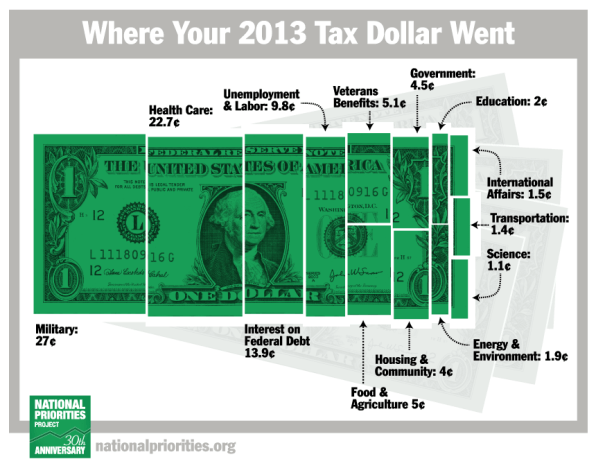

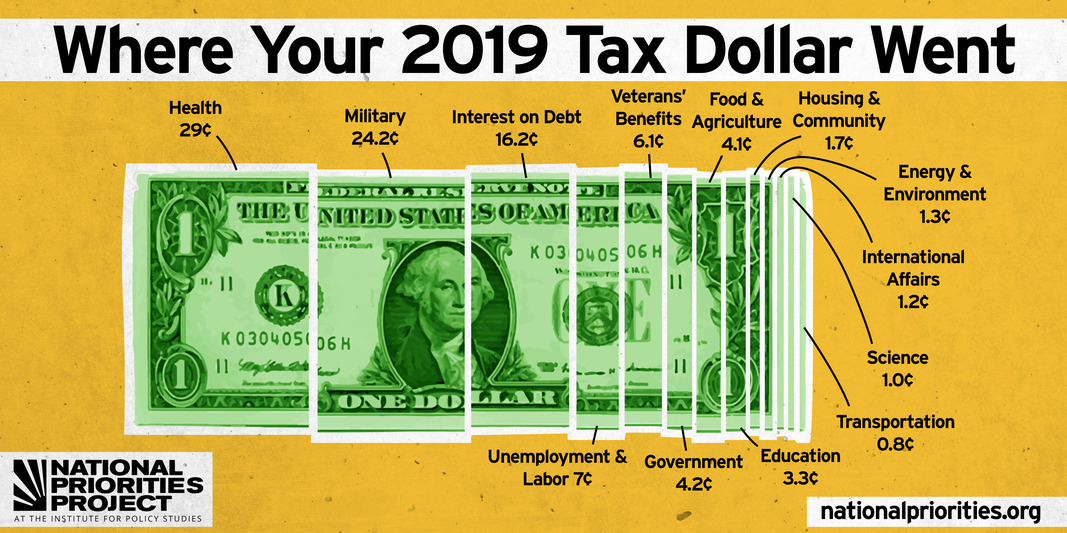

Breaking down your tax dollar. Of that the federal government spent. 329913 or 254 on the Pentagon and the military.

Tax dollars paid for about 85 cents of every dollar spent in 2014 the rest was borrowed. Thats because the Congressional Budget Office includes 274. Where did all that money go.

As a group these pension plans represent the biggest portion of transfers the federal government makes to people directly. Of that 44 trillion over 35 trillion was financed by federal revenues. Well not anymore.

Government operating expenses such as salaries and benefits facilities and equipment and supplies and travel made up 30 cents of each tax dollar spent 817 billion. Updated March 21 2021 US. The remaining amount 984 billion was financed by borrowing.

Most of it is paid either through income taxes or payroll taxes. Last year these cost 481 billion or 15 cents of every tax dollar. Based on 2020 rates the following is the breakdown of where your tax dollars go.

The lower half included taxpayers with AGIs of 41740 or less in 2017. Federal tax revenue is the total tax receipts received by the federal government each year. The Tax Foundation found that this lower 50 demographic contributed just 3 of taxes paid in 2017.

Its time to pull back the curtain and find out where your tax money goes. Every citizen is not a tax-payer. The top 1 percent of taxpayers paid roughly 616 billion or 385 percent of all income taxes while the bottom 90 percent paid about 479 billion or 299 percent of all income taxes.

If IRS spent 135 per citizen to collect tax in US it would cost IRS 424 billion to collect Income tax. 87 on the first 38081 of taxable income 145 on the next 38080 158 on the next 59812 173 on the next 54390 183 on the amount over 190363. Your bracket depends on your taxable income and.

372892 or 287 on health programs. To pay them the government uses approximately 10 cents of every tax dollar or as of 2015 282 billion per year. A study by the Tax Foundation breaks down taxpayers into just two groups.

Tax Dollar Breakdown Where Does My Property Tax Money Go. You might notice that the final tally equals 1060. In US only 36 of citizens are income tax payers.

In 2017 the top 1 percent of taxpayers accounted for more income taxes paid than the bottom 90 percent combined. As in most states in the United States property taxes are the backbone of funding of local government and schools. Some of your tax dollars go directly to people too.

Close to half of this spendingjust over 14 cents of each tax dollar spentwent to just three organizations. Provincial and territorial tax rates combined chart Provinces and territories Rates. Pension plans such as Old Age Security supplements and allowance for the survivor and more take up 16 cents of every tax dollar spent.

In fiscal year FY 2021 income taxes will account for 50 payroll taxes make up. Basically there are three main categories that your tax money pays for. Other transfers the government makes directly to taxpayers are.

There are seven federal tax brackets for the 2020 tax year. Property taxes are an important source of revenue for local schools vocational-technical education libraries city and county government. The top 50 of earners and the bottom 50.

Some quick division means that the average gross income per return was 67564 while the average federal tax hit was 9655. 98 on the first 31984 of taxable income. 10 12 22 24 32 35 and 37.

In fiscal year 2019 the federal government spent 44 trillion amounting to 21 percent of the nations gross domestic product GDP.

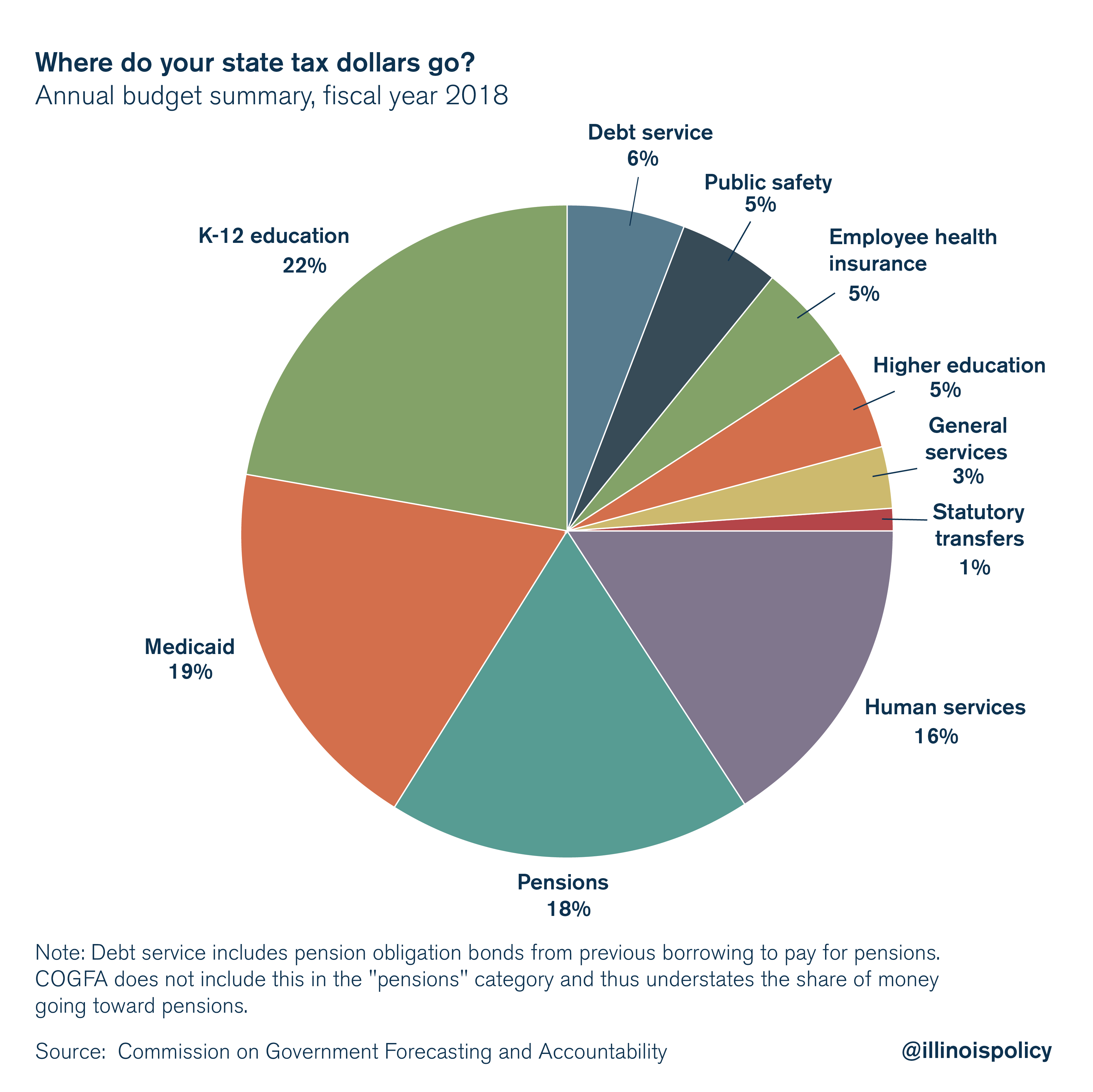

Tax Day Where Do Illinoisans State Tax Dollars Go

Tax Day Where Do Illinoisans State Tax Dollars Go

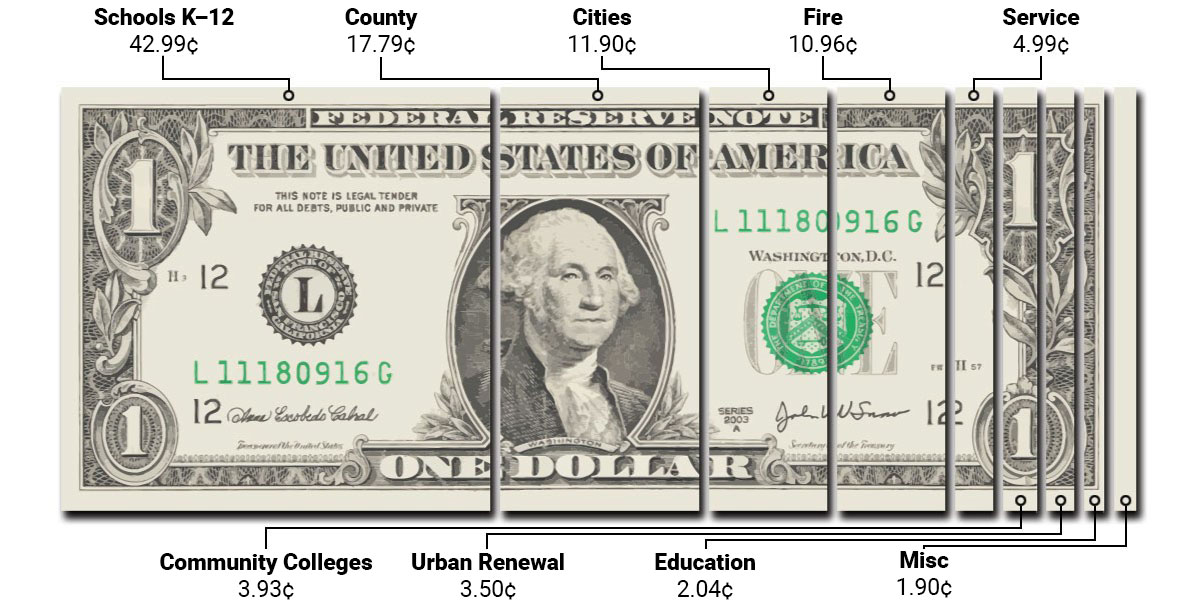

Five Things To Know About The Approved Fy 2017 Budget

Five Things To Know About The Approved Fy 2017 Budget

Where Your Tax Dollars Go Clackamas County

Where Your Tax Dollars Go Clackamas County

Tax Day 2019 Where Your Personal Income Taxes Were Spent In 2018 Institute For Policy Studies

Tax Day 2019 Where Your Personal Income Taxes Were Spent In 2018 Institute For Policy Studies

Here S Where Your Federal Income Tax Dollars Go

Here S Where Your Federal Income Tax Dollars Go

Tax Day 2017 How The Government Spends Your Tax Dollar Fortune

Tax Day 2017 How The Government Spends Your Tax Dollar Fortune

It S Tax Time Do You Know What You Re Paying For

It S Tax Time Do You Know What You Re Paying For

Where Your Tax Dollar Was Spent In 2018

Where Your Tax Dollar Was Spent In 2018

In 1 Graphic Here S What Uncle Sam Is Doing With Your Tax Money The Heritage Foundation

In 1 Graphic Here S What Uncle Sam Is Doing With Your Tax Money The Heritage Foundation

Where Do Your Tax Dollars Go Tax Foundation

Where Do Your Tax Dollars Go Tax Foundation

Your Federal Income Tax Receipt

Your Federal Income Tax Receipt

Where Did Your Federal Income Tax Dollars Go In 2015 Tax Time Inc

Where Do Your Tax Dollars Go Tax Foundation

Where Do Your Tax Dollars Go Tax Foundation

The Breakdown Of Where Your Tax Dollars Go

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.