With the countys current tax rate of 948 cents per 100 of assessed value the credit would be worth 4740. APPLICATION HOMESTEAD TAX CREDIT ELIGIBILITY.

State Of Maryland Homestead Property Tax Credit Archives Go Brent

State Of Maryland Homestead Property Tax Credit Archives Go Brent

Date of Birth 4.

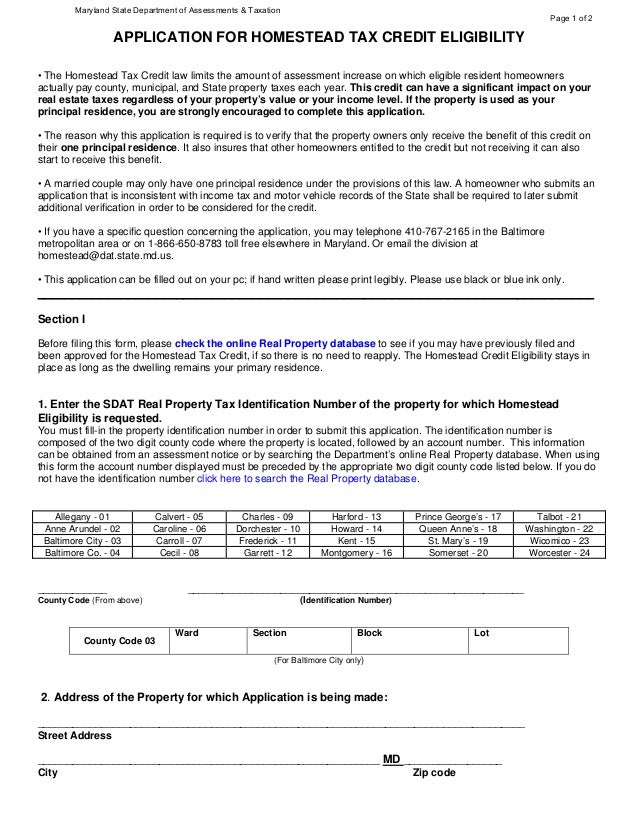

Maryland homestead tax credit application. Please use black or blue ink only. Httpwwwtaxcreditssdatmarylandgov HTC-1 v10 Page 1 of 4. Instead please mail your completed application and supporting documents to the Department so your personal information remains confidential.

For Homestead program questions e-mail. Effective October 1 2007 a new law enacted by the 2007 session of the Maryland General Assembly required all homeowners to make a one-time application in order to be eligible to receive or continue to receive the Homestead Tax Credit. Homestead tax credit eligibility application Maryland Department of Assessments and Taxation CHARLES COUNTY Homestead Tax Credit Division 301 West Preston Street Baltimore MD 212012009 PHTC-1 Enter Property Account Number.

This application can be filled out on your pc. You also may print a PDF copy of the application from our website. Box 49005 Baltimore MD.

Every county and municipality in Maryland is required to limit taxable assessment increases to no more than 10 per year and the State also limits the taxable assessment for the State portion of the tax to 10. Applying for the Homestead Tax Credit To receive the tax credit homeowners must submit a one-time application. You may also download the applications in a PDF format.

The Homestead Tax Credit HTC limits the increase in taxable assessment each year to a fixed percentage. Sdathomesteadmarylandgov Homeowners and Renters Tax Credit applications can now be filed online. Check the Real Property database.

Homeowners Property Tax Credit Application Form HTC 2020 The State of Maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the basis of gross household income. Email the division at sdathomesteadmarylandgov. A homeowner is defined as any living person listed on the deed.

Request an application at 410-767-2165 toll free in Maryland 1-866-650-8783 or Email. Therefore if approved for the credit in 2020 many homeowners will not start receiving the credit until their property is triennially reassessed. Section II YOU MUST ANSWER ALL QUESTIONS AND INCLUDE THE SOCIAL SECURITY NUMBER OF ALL HOMEOWNERS AND SPOUSES EVEN IF THEY ARE NOT LISTED AS AN OWNER ON THE DEED.

Before filing this form please. Mail the application to. The Homestead Credit Eligibility stays in.

Fax the completed application to the Department at 410-225-9344. Homeowners Tax Credit Program PO. If hand written please print legibly.

To qualify for the homestead tax credit there are a number of conditions that must be satisfied. A new application must be filed every year if. Last First Middle Initial 2.

Please do not email any tax credit applications to the Department containing personal information such as social security numbers andor income tax returns. Department of Assessments and Taxation Homestead Tax Credit Division. Homestead Tax Credit Division 301 West Preston Street 8th Floor Baltimore Maryland 21201 Fax the application.

Is the real property shown on this letter currently used and expected to be used in the next calendar year. State of Maryland limits its increase to 10 percent. 2021 Homeowners Property Tax Credit Application HTC-1 Form Filing Deadline October 1 2021 Apply online.

You may fax in the completed paper application to the Department at 410-225-9344 File electronically. According to the Maryland State Department of Taxation and Assessments SDAT 487739 properties in Maryland that are coded as a primary residence or around a third of the 1513029 properties in the state do not have a Maryland Homestead Property Tax Credit application on file. The state requires that the dwelling be the owners principal residence and owners.

Homestead Tax Credit. Maryland State Department of Assessments Taxation. This credit will reduce county and state tax liability and will be reflected in the property tax bill.

The application can be accessed online and includes questions about the property and the property owners. The property was not transferred to new ownership. The Homestead Tax Credit limits the increase in taxable assessments for a principal resident to a fixed percentage each year.

To submit an application for a Homestead tax credit please apply online at httpssdathtcdatmarylandgov. See if you may have previously filed and been approved for the Homestead Tax Credit if so there is no need to reapply. The online application is available at httpssdathtcdatmarylandgov Please do not mail any tax credit applications to the Department containing personal information such.

Social Security Number 3. The tax credit will be applicable if the following conditions are met during the previous tax year. All municipalities in Montgomery County have adopted the 10 HTC limit except for.

Http Www Talbotcountymd Gov Uploads File Finance Homestead 20tax 20credit 20powerpoint 20final Pdf

Http Www Talbotcountymd Gov Uploads File Finance Homestead 20tax 20credit 20powerpoint 20final Pdf

Homestead Tax Credit In Md 2012

Homestead Tax Credit In Md 2012

Homestead Tax Credit Great News For Maryland Homeowner S

Https Dat Maryland Gov Sdat 20forms Homestead Application Pdf

What Is Maryland S Homestead Tax Credit Law Blog

What Is Maryland S Homestead Tax Credit Law Blog

Https Www Calvertcountymd Gov Documentcenter View 30965 2020 Homeowners Tax Credit Application Bidid

Last Chance Apply For Homestead Tax Credit Anne Arundel Md Patch

Last Chance Apply For Homestead Tax Credit Anne Arundel Md Patch

Homestead Tax Credit In Md 2012

Homestead Tax Credit In Md 2012

The Important Maryland Tax Credit You Might Be Missing Out On Christa Emmer

The Important Maryland Tax Credit You Might Be Missing Out On Christa Emmer

Http Www Talbotcountymd Gov Uploads File Finance Homestead 20tax 20credit 20powerpoint 20final Pdf

Https Www Lincolninst Edu Sites Default Files Gwipp Upload Sources Maryland 2017 Md Maryland 20homestead 20tax 20credit For Large 20 Assessment Increases 2017 Pdf

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.