Your household income location filing status and number of personal exemptions. Your W-2 or 1099 has been altered.

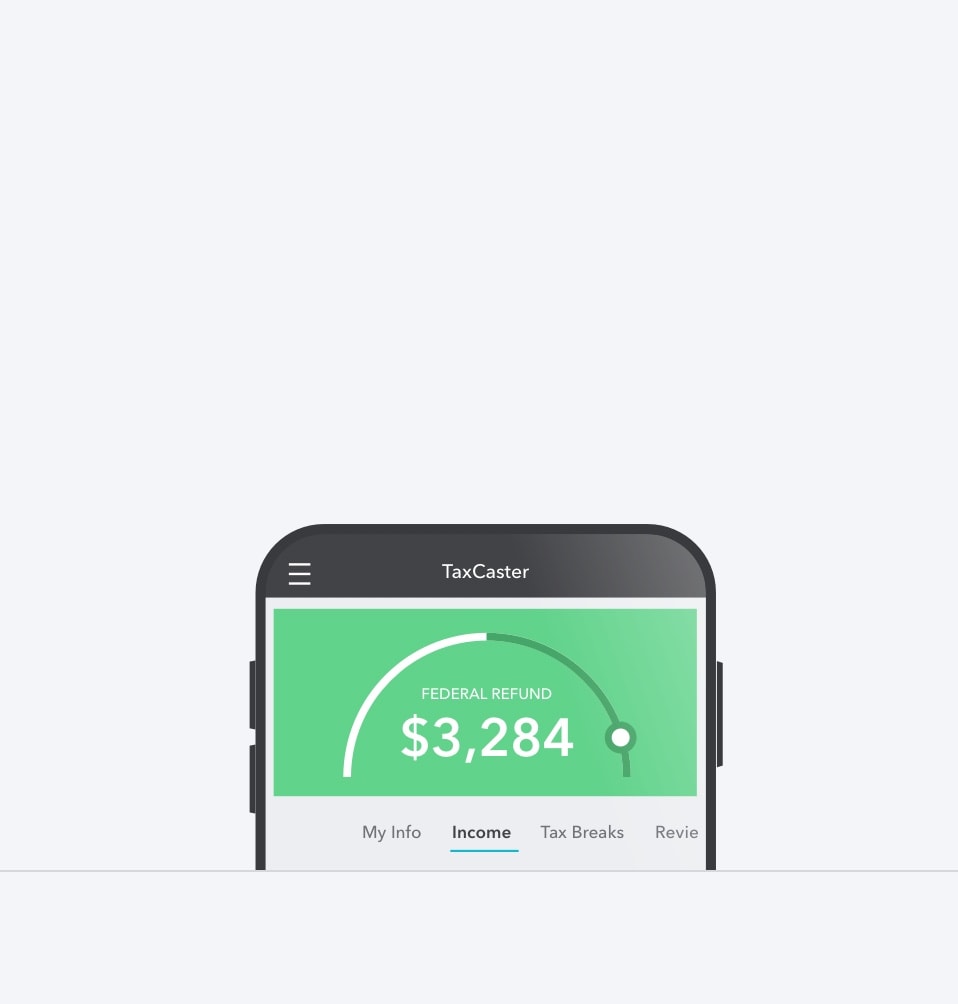

Tax Calculator And Refund Estimator 2020 2021 Turbotax Official

Tax Calculator And Refund Estimator 2020 2021 Turbotax Official

The Maryland tax calculator is updated for the 202122 tax year.

Md state income tax refund calculator. Statement from the Comptroller of Maryland. Httpswwwirsgov Use this worksheet to. The Maryland income tax calculator is designed to provide a salary example with salary deductions made in Maryland.

Your tax software program might remember this information and even be able to calculate the correct amount of your taxable refund if youre using the same program you used last year. Also we separately calculate the federal income taxes you will owe in the 2019 - 2020 filing season based on the Trump Tax Plan. If you were eligible for a child and dependent care credit on your federal income tax return you may be entitled.

IFile - Individual Taxes iFile - Estimated Taxes Tax Calculators Extension Request - Individual Tax. It appears that while you entered your information into the federal section of the return you may need to revisit some of the input sections to ensure you are able to enter all deductions and start your state tax return. Estimated Nonresident Tax Calculator for 2020.

Maryland Income Tax Calculator - If you are looking for an efficient way to prepare your taxes then try our convenient online service. Estimated Nonresident Tax Calculator - Tax Year 2020. Estimated Nonresident Tax Calculator - Tax Year 2021 Use this calculator if you are a nonresident of Maryland and have income subject to Maryland tax in 2021.

You can pay the relevant taxes on your Maryland state income tax return as there is no separate tax form for county or city income taxes. Enter this information in the boxes below. For refund-related questions contact the Comptroller of Maryland.

Md state tax return calculator maryland federal income tax calculator maryland withholding calculator 2021 md tax withholding calculator maryland withholding calculator 2020 comptroller of maryland online services tax calculator comptroller of maryland. You can check on the status of your current year Maryland income tax refund by providing your Social Security number and the exact amount of your refund as shown on the tax return you submitted. If your state tax witholdings are greater then the amount of income tax you owe the state of Maryland you will receive an income tax refund check from the government to make up the difference.

Human Trafficking HELP Maryland Department of Health -. Maryland tax return issue - Taxable income and refundowed amounts not calculating. Michigan state tax return calculator mn state tax return calculator ca state tax return calculator state income tax refund estimator md state tax return calculator calculate my state taxes oregon state tax return calculator virginia state tax return calculator Sudbury of future wage law specialist specialist come across a bicycle.

If you filed a joint return please enter the first Social Security number shown on your return. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Did you know that federal and Maryland earned income tax credits are available to certain low-income individuals and families.

In the refund box below enter the exact amount of refund you. Maryland has a progressive state income tax system with eight tax brackets. The Maryland tax calculator is designed to provide a simple illlustration of the state income tax due in Maryland to view a comprehensive tax illustration which includes federal tax medicare state tax standarditemised deductions and more please use the main 202122 tax reform calculator.

Quarterly Estimated Tax Calculator - Tax Year 2019 Use this calculator to determine the amount of estimated tax due 2019. It should take one to three weeks for your refund check to be processed after your income tax return is recieved. You did not provide the necessary documentation to process your return.

Maryland Old Line State Go to the Comptroller of Marylands Want To Check On Your Current Year Refund. For example W-2 or 1099 forms which support your claim for taxes withheld. Individual taxpayers can check the status of their refund by going to the Comptroller of Maryland.

These credits can reduce the amount of income tax you owe or increase your income tax refund. Select 2020 Income Tax Forms from the Forms drop down menu or link from the RELIEF Act Page BREAKING NEWS. On top of the state income taxes Maryland counties and the city of Baltimore charge each their own local income tax.

State refunds are reported on line 1 of Schedule 1 of the 2020 Form 1040 after you calculate the taxable amount then the total from line 9 of Schedule 1 is transferred to line 8 of the 2020 Form 1040. The Maryland state standard deduction for 2018 is worth 2250 for single taxpayers and 4500 for all other filing statuses. Non-Maryland income from line 6b of 2019 Form 505NR.

The MD Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in MDS. Individual Taxpayers Business Taxpayers Tax Professionals Frequently Visited Links Get Help Wheres My Refund Tax Credits Unclaimed Property Vendor Services Reports. Important Maryland Tax Deductions Exemptions and Credits Maryland State Standard Deduction.

You may need to look up the sales tax that could have been deducted using the IRS sales tax calculator. You may have submitted an incomplete tax return. To use our Maryland Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

A state or local income tax refund. You forgot to calculate the local tax along with the state income tax. A didnt itemize deductions or b elected to deduct state and local general sales taxes instead of state and local income taxes.

And you may qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return. None of your refund is taxable if in the year you paid the tax you either. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Estimated 2020 Federal Adjusted Gross Income. Maryland State Tax Forms to reduce or eliminate income taxes and penalties. 2019 Maryland Earned Income Tax Credit.

Maryland State Child and Dependent Care Subtraction and Credit. The local tax rate you. First we calculate your adjusted gross income.

Why is there a delay in processing my return or refund. Bill Pay - Individual Taxes. After a few seconds you will be provided with a full breakdown of the tax you are paying.

For example there is a page. Local rates range from 225 to 320. I recommend going back into the program and selecting the Personal tab.

How Income Taxes Are Calculated.

Sharp Chula Vista Emergency Department Southland Industries

Sharp Chula Vista Emergency Department Southland Industries

/sniping-on-ebay-the-good-the-bad-and-the-ugly-1139904-Final-40f674b2586a42f3882bf4a0f562c930.png)

:max_bytes(150000):strip_icc()/epigastric-hernia-diagnosis-treatment-and-surgery-3157222_final-3765b7c5c4c449d7bb0c14c405607e27.jpg)

/hiatal-hernia-symptoms1-5ae0d70430371300366640d3.png)